In the last two years, unexpected interest rate hikes have significantly increased homeowners’ monthly costs across the country. This financial pressure has hit real estate investors and landlords particularly hard, leading to negative monthly cash flows and, in many cases, substantial losses. Many investors began offloading their rental properties in 2023 to avoid these losses and reallocate their capital elsewhere, causing a displacement of tenants, most of which are re-entering the rental pool at a higher cost and with low supply. Higher borrowing costs reduce the attractiveness of buying new properties, especially when rental income does not cover expenses.

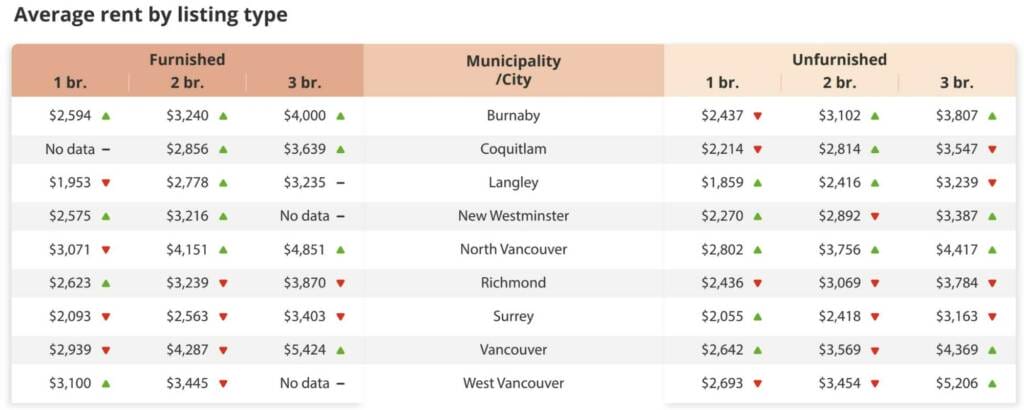

With low supply, we’ve observed rental rates in Metro Vancouver climb and the vacancy rate fall to below 1%. The average cost for an unfurnished one-bedroom condo in Metro Vancouver is now just under $2400 a month. Which city has the highest rents? North Vancouver stands out, with an average rent for a one-bedroom unit slightly over $2800.

Today offers a great opportunity for investing in real estate. Expected interest rate drops in the next few years could increase buyer demand and raise property values. With rental rates rising and property prices stable for the last two years, investing now offers a chance for both capital growth and solid rental income. This situation provides a unique opportunity for those looking to invest before the market heats up further.

See Full Liv Rent Report for February 2024 Below