G+D home buyers guide

Steps to Buying a Home in Greater Vancouver

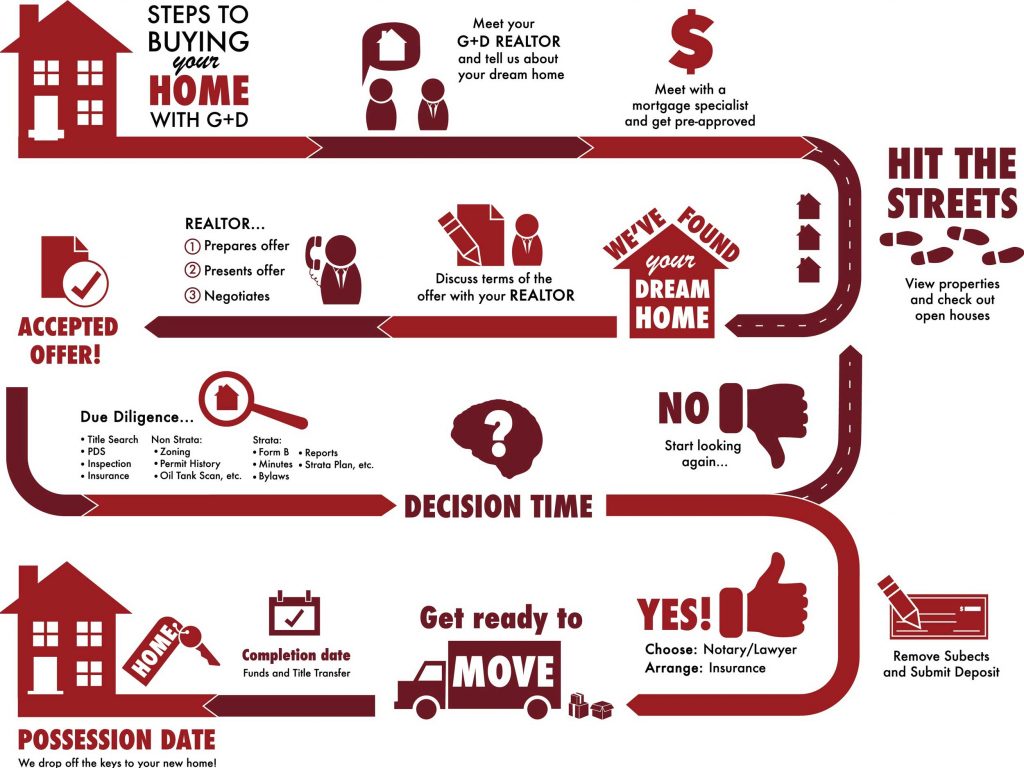

Embarking on the journey to find your dream home in Greater Vancouver involves several key steps:

- Looking For A Home: Begin your search with a clear idea of what you’re looking for in your ideal home.

- Making An Offer: Once you find a home you love, take the step to make an offer.

- Offer Negotiation: Engage in the negotiation process to arrive at terms agreeable to both you and the seller.

- Moving Into Your Home: Prepare for the exciting move into your new space.

- Mortgage Information: Understand your financing options and secure a mortgage that fits your needs.

- Real Estate Closing Costs: Be informed about the closing costs associated with purchasing a home.

- Real Estate Terms & Definitions Glossary: Familiarize yourself with real estate terms to navigate the buying process confidently.

To support you through these steps, having a team of skilled professionals by your side is crucial. We’ve gathered a list of resources to assist you in the process of buying your new home.

As a dedicated team of real estate agents, we aim to provide an exceptional buying or selling experience. We prioritize making informed decisions and always put our clients’ best interests first. Join us on your home-buying journey in Greater Vancouver, and let’s make your dream home a reality.

STEPS TO BUYING A HOME