Mortgage Options for First-Time Home Buyers

Alex joins Denny once again, this time to talk about all the options first-time home buyers have when trying to qualify for a mortgage. Denny and…

Alex joins Denny once again, this time to talk about all the options first-time home buyers have when trying to qualify for a mortgage. Denny and…

Alex McFadyen is back with Denny to talk about presale completions and provide you with valuable insights on how to ensure you are well-prepared for this…

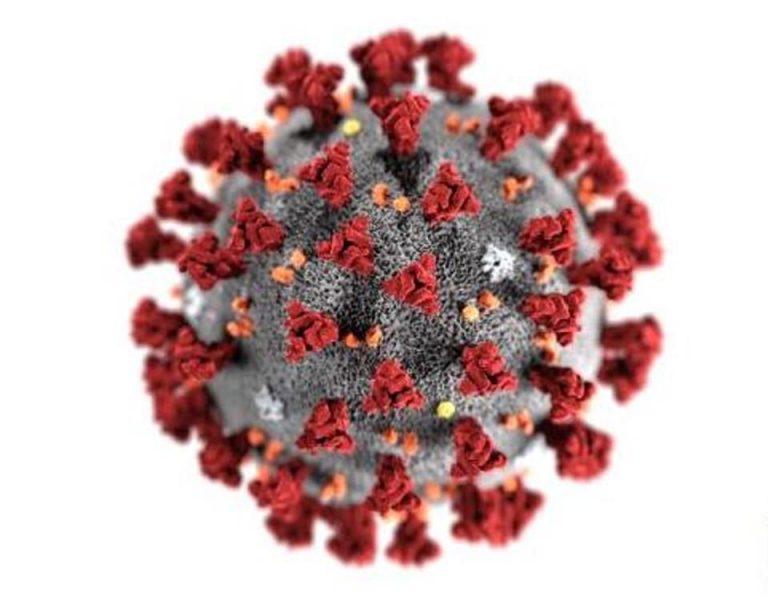

COVID-19 is affecting all aspects of life, so what exactly is it doing to the residential financing world? Alex McFadyen from Thrive Mortgage CO and the…

As Vancouver settles into accepting social distancing and staying at home as the current norm, the real estate industry moves along but with some changes. James…

In a busy Vancouver market dealing with multiple offers on a property is common. In a seller’s world, this can be a great situation to be…

Buying a detached home will most likely be the largest purchase of your life so knowing what to look for can make a world of difference….

As the Vancouver markets starts to heat up, multiple offers become the norm and can be very frustrating especially for those looking to buy. James and…

Strata Condos and townhomes in British Columbia are on the verge of an insurance crisis due to rising premiums. Increased number of claims, construction costs and…

When is the best time to list your home? Does buying/selling a home at different times throughout the year make a difference? James and Denny go…

Mortgages are complicated. Shaun Francis is the Principal and Senior Mortgage Consultant at Bespoke Lending Solutions and joins James and Denny to share information with anyone…

Steady trends continue in the Greater Vancouver housing market Consistent home sale and listing activity has allowed balanced market conditions to prevail in the Greater Vancouver…

On June 21st Finance Minister Jim Flaherty unveiled the new Mortgage rules that took effect this past Monday July 9th. The LTV (Loan to Value)…

End of content

End of content