You have found your dream home and are wanting to put in an offer. Watch this video from 2016 and review the updated list of 10 due diligence steps you should take to ensure you can move forward with confidence in 2021.

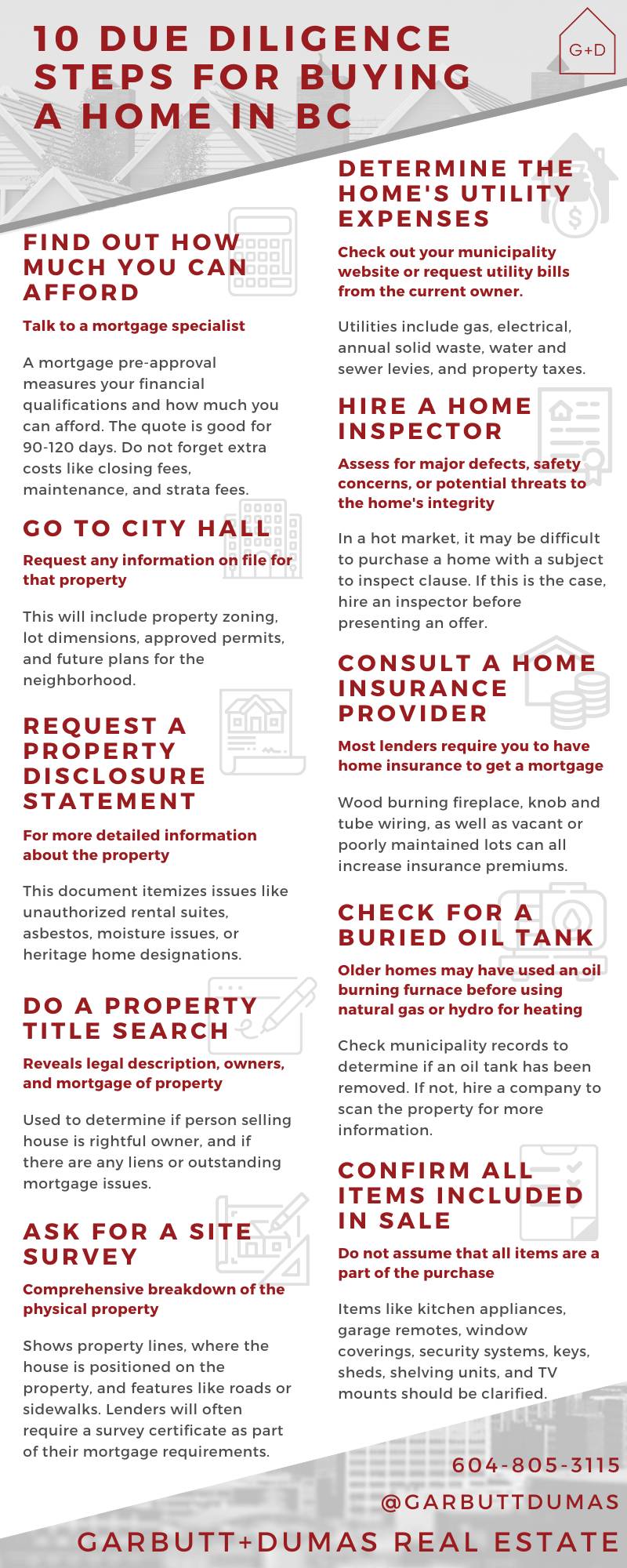

1. Find Out How Much you Can Afford

A mortgage broker or a mortgage specialist at your bank can take you through the steps to get pre-approved for a mortgage. A good mortgage pre-approval accurately measures your financial qualifications and how much house you can afford. Furthermore, the financial institution will provide a 90 or 120-day guarantee of its mortgage rate in case those rates jump while you are shopping. For more information on mortgage pre-approvals, visit the Government of Canada website.

It is important to note that a pre-approval isn’t a firm approval. When you’re ready to make a purchase, the lender will likely want to appraise the property to ensure that you’re paying market value and the property has an adequate lifespan. If the purchase price is well above market value or the home is deemed to have a short life expectancy, you may require a higher down payment. In some cases, the bank may not give you a mortgage at all.

When setting your budget, do not forget to factor in costs like closing fees and maintenance or repairs. Another cost to consider is condo strata fees.

2. Go to City Hall

Another due diligence step is to request any information City Hall may have on record about the property such as its zoning, lot dimensions, permits that have been issued or any future plans for the surrounding area. Checking the zoning is especially important if you’re planning to operate a business out of your residence, renovate or redevelop, or rent a suite in the home. Review all extensive renovations for proper permits.

3. Request a Property Disclosure Statement

While property disclosure statements are not required under BC law, realtors will often ask for one from the property’s current owner so they can give buyers as much detailed information about a property as possible. The property disclosure statement is a three-page document that itemizes potential problems like renovations done without a permit, unauthorized rental suites, asbestos insulation, unregistered easements or whether the seller is aware of any issues like the presence of an underground oil tank, moisture problems, if the property was ever used as a grow op, or if it has ever been designated as a heritage site. The statement can be legally incorporated into the contract for purchase and sale.

4. Do a Title Search on the Property

A title search will confirm whether the person selling you their property is actually the rightful owner. It will also determine whether there are any easements, right-of-ways, or covenants against the property that could affect its future development. It will show if there are liens or outstanding mortgages on the property. Click here for more information.

5. Ask for a Site Survey

A site survey will tell you what you are buying. It shows the property lines, how the property is aligned with neighbouring properties, and features like roads or sidewalks. It will also show where the house is positioned on the property. A lender will often require a survey certificate as part of their mortgage requirements. In some cases, the lender will request a title insurance policy instead of a survey certificate, and sometimes they will ask for both. Title insurance protects the lender against potential issues with a property such as encroachment or past fraud.

For more information about site surveys, visit the BC Land Title & Survey website.

6. Find out the Home’s Utility Expenses

Another due diligence step is finding out the home’s utility expenses. Utilities include gas, electrical, annual solid waste, water and sewer levies, and property taxes. Your realtor can request utility bills from the property’s current owner. Water/sewage rates as well as the taxes for a particular property can usually be found on a municipality’s website.

7. Hire a Home Inspector

A qualified home inspector will walk through and around the property to assess any major defects, safety concerns, or potential threats to the integrity of the home. Keep in mind that there are limitations to these inspections as they cannot see behind walls.

In a hot market it can be difficult, even impossible, to purchase a home with a “subject to inspection” clause. When this is the case, hire an inspector before presenting an offer. When you’re considering the qualifications of a home inspector, assess their knowledge, experience, training, certification, licensing and their level of participation in the industry. For more information, listen to our podcast episode on the benefits of working with an experienced home inspector.

8. Consult a Home Insurance Provider and Purchase a Home Warranty

Most lenders are going to require you to have insurance in place in order to get a mortgage. Home insurance helps pay for structural damage and loss of personal property from emergencies like theft or fire. If you’re buying an older home that has a wood-burning fireplace or knob-and-tube wiring, you may encounter some issues getting insurance or have to pay higher premiums. Insurance companies can deny coverage if the property has been poorly maintained or vacant for an extended period of time. Renovations could also affect your ability to get an insurance policy. Remember that events like sewer backups and earthquakes are not typically included in basic policies.

A home warranty covers the repairs and replacements of your home’s major systems and appliances when they fail from old age. Carry out thorough research to compare different companies to find the best plan that meets your family’s future needs.

9. Check for a Buried Oil Tank

If you are purchasing an older home, your due diligence should include confirming there is no oil tank buried on the property. Many homes used an oil-burning furnace that was fueled from a tank buried somewhere on the property before the widespread adoption of natural gas or hydro for heating.

Some municipalities keep records of properties known to have oil tanks, or those that have had old tanks decommissioned. This is a great place to start.

New Westminster: call the fire prevention office to see if they have anything on file for your property

Burnaby: send an email to ac.ybanrub@erif

Vancouver: call the city’s information line at 3-1-1 to check if there are any records for oil tank removals or abandonments

Coquitlam: call Coquitlam Fire & Rescue at 604-927-6400 to have them check their records

If those searches come up empty, you’ll have to check with the current owner to see if they have had the property scanned for an oil tank, or else hire a company that can do the scan. A basic scan will cost you between $80 – $150. It includes a technician scanning the property with a metal detector and probing device. For a more accurate and detailed scan, consider a company that uses Ground Penetrating Radar (GPR). Low clearance decks and metal debris may affect the ability to get a conclusive scan.

The decommissioning and removal of old oil tanks is labourious and expensive, especially if it’s leaking oil into the soil. Be aware that if a tank is discovered after you’ve acquired the property, you will be responsible for its removal as well as any remediation for the surrounding soil. Visit the British Columbia website for more information about residential heating oil storage tanks.

10. Confirm all the Items Included in the Sale

Unless specifically written into the contract, appliances like the stove, refrigerator, dishwasher or microwave may not included in the purchase. Garage remotes, window coverings, curtains, keys, sheds, appliances and corresponding warranty manuals, potted plants, shelving units that aren’t attached to walls are all items that should be specifically written into a contract. The inclusion of fixtures like TV mounts, blinds, security systems, hood fans and central vacuum systems should also be clarified.

It is also a great idea to research the neighbourhood and find out more information about where you will be living. Mapping out your daily commute to work, finding the best shopping centers and stores, and getting a better feel for your neighbours is a great start.

Once your due diligence checks out and you are confident in your purchase decision, you can remove subjects, submit your deposit, and wait for the day when you get the keys to your new home!